Mayar Is Fully Invested

Aziz and the investment team have acted in the current sell-off by fully investing the portfolio and bringing cash down to almost zero. Buy why now? Aren’t we worried about conflict in Europe, rising inflation and increasing interest rates?

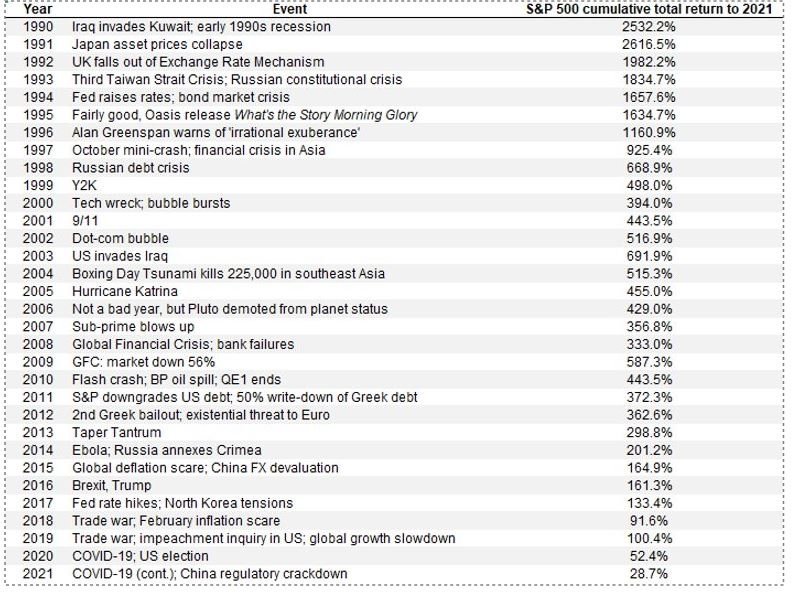

There Is Always Something To Worry About

There’s always something to worry about. The problem is knowing what that ‘thing’ is. The issue with adjusting or changing strategies in response to headlines is that we don’t know what the market reaction will be. In December 2019, no-one was worrying about a pandemic. Yet even with perfect foresight of how COVID-19 would impact all of our lives, who would have predicted that global stock markets would return 41.2% between Jan 2020 and December 2021? While we are naturally concerned about the human impact of the Russia/Ukraine conflict, our job as investors is to understand what our investments will look like in 5 or even 10 years’ time. In the short-term, it is possible that Putin could manufacturer a ‘successful’ end to the war, announce mission accomplished with global energy process falling in response and reduction in inflationary pressures. It is possible that the conflict deepens.

Source: JPMorgan Private Bank, Mayar Capital

Our response is to invest in companies that have experience in navigating difficult macroeconomic conditions and have strong competitive advantages to maintain market position. Think of all the things we have been worrying about over the past 15 years. Pandemics, Trade Wars, Natural Disasters and the small matter of the Global Financial Crisis. If you had bought the MSCI World 15 years ago, closed your eyes, on opening them today, that investment will have trebled. The truth is that we do not know what the next few months will bring so it is impossible to answer accurately what strategy will be best. Except whatever the answer, it is never crypto.

A number of high-growth tech stocks that were particularly popular during the height of the pandemic, such as Peloton, are now seeing widespread sell-offs. We have been focusing on different parts of the sector. For example, we believe that companies such as Dropbox and PayPal have been unfairly punished in the broad ‘Post-Lockdown’ sell-off. PayPal is becoming more of a network to facilitate payments than its roots as a simple money transfer tool and is currently under-appreciated by the market. We think that over the longer-term this provides the setting for far less volatile earnings profile than is reflected in short-term market volatility – and that’s the opportunity.

What’s more, instead of extrapolating what are potentially short-term trends indefinitely into the future, we pride ourselves on digging deep for those hidden value stocks in our search for alpha.

In volatile times, investors should keep a cool head and avoid any knee-jerk reactions – there will always be something to worry about when it comes to financial markets, the problem is knowing what that ‘thing’ is from one moment to the next. If you constantly adjust your investment strategy in response to headlines, you are forgetting that some of the biggest historical rallies the stock market has seen were often preceded by the biggest falls.

Focus on what you can control. Invest in companies that have experience in navigating difficult macroeconomic conditions and have strong competitive advantages to maintain market position – aka ‘strong moats.’ The best course of action throughout all the crises that have pockmarked the last 200 years is to have bought equities and held them for the long term, so the barrier to investing based on whatever is the crisis du jour has historically been incredibly low.

In fact, many mutual Fund investors have lost out by taking the wrong action at the wrong moment. The annual “Mind the Gap” study of dollar-weighted returns (also known as investor returns) finds investors earned about 7.7% per year on the average dollar they invested in mutual funds and exchange-traded funds over the 10 years ended Dec. 31, 2020. This was about 1.7 percentage points less than the total returns their fund investments generated over that span. This shortfall, or “gap,” stems from inopportunely timed purchases and sales of fund shares, which cost investors nearly one sixth the return they would have earned if they had simply bought and held.

The persistent gap between the returns investors actually experience and reported total returns makes cash flow timing one of the most significant factors--along with investment costs and tax efficiency--that can influence an investor’s end results.